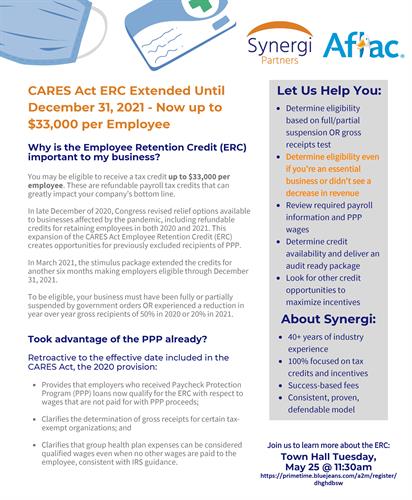

Employee Retention Credit Town Hall with Aflac

Businesses may be eligible to receive a tax credit up to $33,000 per employee. These are refundable payroll tax credits that can greatly impact your company’s bottom line.

Aflac has teamed up with Synergi Partners, which is a company that actually helped with the legislation as it was being written.

Through current legislation, the ERC has been extended through December 31, 2021. Businesses may be eligible to receive a tax credit up to $33,000 per employee through this legislation that is in effect. The ERC was previously unavailable as an option for relief for businesses that received Paycheck Protection Program (PPP) loans through the SBA. However, the new legislation explicitly provides a retroactive amendment to March 13, 2020 and clarifies these businesses are now eligible ERC, just not on wages paid with PPP loan funds.

The Town Hall meeting will be streamed live for your convenience.

You can register for the online event by clicking here.

Date and Time

Tuesday May 25, 2021

11:30 AM - 1:00 PM EDT

Tuesday, May 25 at 11:30am

Location

Virtual Meeting

Fees/Admission

Free; Open to the Public

Contact Information

Ronell Thompson

843.655.0560

Send Email